Contents:

“MBT” stock predictions are updated every 5 minutes with latest exchange prices by smart technical market analysis. The M&T Bank 52-week low stock price is 110.00, which is 6.9% below the current share price. The M&T Bank 52-week high stock price is 193.42, which is 63.7% above the current share price.

Investing.com – Philippines equities were higher at the close on Thursday, as gains in the Property, Holding Firms and Services sectors propelled shares higher. Investing.com – Philippines equities were higher at the close on Thursday, as gains in the Banking & Financials, Services and Property sectors propelled shares higher. Investing.com – Philippines equities were lower at the close on Wednesday, as losses in the Holding Firms, Industrials and Services sectors propelled shares lower. Investing.com – Philippines equities were lower at the close on Wednesday, as losses in the Banking & Financials, Property and Holding Firms sectors propelled shares lower. Investing.com – Philippines equities were lower at the close on Friday, as losses in the Property, Holding Firms and Banking & Financials sectors propelled shares lower. Investing.com – Philippines equities were higher at the close on Tuesday, as gains in the Holding Firms, Property and Industrials sectors propelled shares higher.

Stock Stat

Information is provided ‘as-is’ and solely for informational purposes, not for trading purposes or advice, and is delayed. To see all exchange delays and terms of use please see Barchart’s disclaimer. Real-time analyst ratings, insider transactions, earnings data, and more. 77 employees have rated Mobile TeleSystems Public Joint Stock Chief Executive Officer Arthur V. Ty on Glassdoor.com.

Net money flow is the value of uptick trades minus the value of downtick trades. Our calculations are based on comprehensive, delayed quotes. Brokerage services for US-listed, registered securities are offered to self-directed customers by Open to the Public Investing, Inc. (“Open to the Public Investing”), a registered broker-dealer and member of FINRA & SIPC. Additional information about your broker can be found by clicking here. Open to Public Investing is a wholly-owned subsidiary of Public Holdings, Inc. (“Public Holdings”).

Metropolitan Bank and Trust Co News

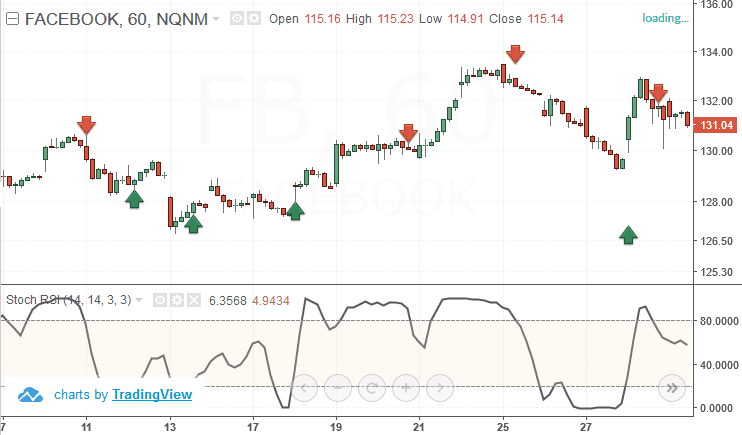

Metropolitan Bank & Trust Company, together with its subsidiaries, provides various commercial and investment banking products and services in the Philippines, rest of Asia, the United States, and Europe. Its Consumer Banking segment offers consumer type loans and support for the sourcing and generation of consumer business. The company’s Corporate Banking segment engages in handling loans and other credit facilities; and provides deposit and current accounts for corporate and institutional customers. Its Investment Banking segment offers structured financing; services relating to privatizations, initial public offerings, and mergers and acquisitions; and advisory services to individuals and institutions.

- Market data provided is at least 10-minutes delayed and hosted by Barchart Solutions.

- Investing.com – Philippines equities were higher at the close on Thursday, as gains in the Holding Firms, Banking & Financials and Industrials sectors propelled shares higher.

- Its Branch Banking segment handles branch deposits, as well as offers loans and other loan related products for middle market clients.

- This website is using a security service to protect itself from online attacks.

This, combined with strong agreement among Wall Street analysts in revising earnings estimates higher, indicates a potential trend reversal for the stock in the near term. Russian stocks are rising today as markets partially reopen. It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website. Dividend yield shows how much a company pays its shareholders in dividends annually per dollar invested. It reflects how much an investor will earn aside from any capital gains in the stock.

Quantity of Shares/Units

This is not an offer, solicitation of an offer, or advice to buy or sell securities or open a brokerage account in any jurisdiction where Open to the Public Investing is not registered. Securities products offered by Open to the Public Investing are not FDIC insured. Apex Clearing Corporation, our clearing firm, has additional insurance coverage in excess of the regular SIPC limits. The Price-to-Earnings (or P/E) ratio is a commonly used tool for valuing a company. It’s calculated by dividing the current share price by the earnings per share .

If You Are Seeking Alpha, Look At Alpha Lithium (TSXV:ALLI:CA) – Seeking Alpha

If You Are Seeking Alpha, Look At Alpha Lithium (TSXV:ALLI:CA).

Posted: Wed, 18 Jan 2023 08:00:00 GMT [source]

CompareMBT’s historical performanceagainst its industry peers and the overall market. Forward P/E gives some indication of how cheap or expensive a stock is compared with consensus earnings estimates. The lower the Forward P/E, the cheaper the stock. Price/sales represents the amount an investor is willing to pay for a dollar generated from a particular company’s sales or revenues. Style is an investment factor that has a meaningful impact on investment risk and returns. Style is calculated by combining value and growth scores, which are first individually calculated.

Independent Director recently sold ₱130k worth of stock

He lives financially free trading this One Stock Once per month… This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. Screen for heightened risk individual and entities globally to help uncover hidden risks in business relationships and human networks. Mobile TeleSystems Public Joint Stock’s most recent n/a dividend payment of $0.2370 per share was made to shareholders on Tuesday, October 12, 2021.

Fusion Mediawould like to remind you that the data contained in this website is not necessarily real-time nor accurate. We sell different types of products and services to both investment professionals and individual investors. These products and services are usually sold through license agreements or subscriptions.

capital adequacy ratio/book ratio can tell investors approximately how much they’re paying for a company’s assets, based on historical, rather than current, valuations. Historical valuations generally do not reflect a company’s current market value. Value investors frequently look for companies that have low price/book ratios. Money Flow Uptick/Downtick RatioMoney flow measures the relative buying and selling pressure on a stock, based on the value of trades made on an “uptick” in price and the value of trades made on a “downtick” in price. The up/down ratio is calculated by dividing the value of uptick trades by the value of downtick trades.

Provide specific products and services to you, such as portfolio management or data aggregation. Investing.com – Canada equities were lower at the close on Monday, as losses in the Energy, Mining and Healthcare sectors propelled shares lower. You’ll find the closing price, open, high, low, change and %change of the Metropolitan Bank and Trust Co Stock for the selected range of dates. The data can be viewed in daily, weekly or monthly time intervals. At the bottom of the table you’ll find the data summary for the selected range of dates. Investing.com – Philippines equities were higher at the close on Thursday, as gains in the Banking & Financials, Mining & Oil and Industrials sectors propelled shares higher.

Second quarter 2022 earnings: Revenues exceed analysts expectations while EPS lags behind

All https://1investing.in/s involve the risk of loss and the past performance of a security or a financial product does not guarantee future results or returns. An affiliate of Public may be “testing the waters” and considering making an offering of securities under Tier 2 of Regulation A. No money or other consideration is being solicited and, if sent in response, will not be accepted. No offer to buy securities can be accepted, and no part of the purchase price can be received, until an offering statement filed with the SEC has been qualified by the SEC. An indication of interest to purchase securities involves no obligation or commitment of any kind. Some stock charts might currently not be supported.

It offers a range of mobile and fixed line voice and data telecommunications services, including data transfer, broadband, pay-TV, and various value-added services, as well as sells equipment and accessories. The company was founded in 1993 and is headquartered in Moscow, the Russian Federation. JSI uses funds from your Treasury Account to purchase T-bills in increments of $100 “par value” (the T-bill’s value at maturity). The value of T-bills fluctuate and investors may receive more or less than their original investments if sold prior to maturity. T-bills are subject to price change and availability – yield is subject to change.

The 16 analysts offering 1 year price forecasts for MBT have a max estimate of — and a min estimate of —. Bloomberg Markets Asia Bloomberg Markets Asia. Live from Hong Kong, bringing you the most important global business and breaking markets news information as it happens. Sell every Stock except ONE Markets are down…But Jeff Clark couldn’t care less because he ignores almost every stock in the market except ONE.

We’d like to share more about how we work and what drives our day-to-day business. You can find your newly purchased MBT stock in your portfolio—alongside the rest of your stocks, ETFs, crypto, and alternative assets. What analysts recommend for MBT stock, on a scale from 1 to 5. This info isn’t a recommendation for what you should personally do, so please don’t take the data as investment advice.